|

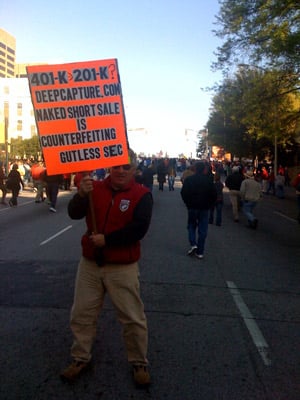

| An intrepid Deep Capture supporter |

Deep Capture is not just a few journalists investigating the biggest financial scandal of our era. It is part of a much larger effort – a movement that is supported by countless people.

It is the former high-level banker who makes sure his senator reads our articles. It is the man in Boston who volunteers his time to help us research connections between market manipulators and organized crime. It is the PhD who works in the humanities, but has nonetheless produced dozens of erudite reports on the intricate mechanics of stock delivery failures.

It is the tough businessman who has filled his garage with boxes containing evidence of short seller miscreancy. It is the Wall Street insiders who have given us tips and valuable information. It is statisticians, economists, and investigators who have toiled long hours — identifying trading patterns that suggest that illegal naked short selling is a much bigger problem than we had previously believed.

It is the bloggers and former stock brokers who warned the world about abusive short selling long before Deep Capture was founded. It is the many people—unorganized and unpaid–who go on Internet message boards to do battle with organized bashers who are paid by hedge funds to whitewash the naked short selling scandal.

It is former government officials, academics, and business people who are lobbying for reform. It is the hundreds of people who have sent us letters of support, and the thousands of people who have contacted the media, the SEC, and members of Congress.

It is a great many more people–millions of people, we reckon–who have come to recognize that abusive short selling was perhaps the most important factor in the near total collapse of our financial system…millions of people who are telling other people that this nonsense must be stopped or things will get much, much worse.

To all of these people, we say, “Thank you — and welcome to the Deep Capture team.”

And to the man in the photo, we say, “You are awesome.”

The photo was taken at one of the “tea parties” held across the nation last week. We did not know this man until a few weeks ago. But he has years of relevant experience and firsthand knowledge of the markets. We did not ask him to lug that sign around all day. He took it upon himself to help us get the word out.

That so many others are doing the same is a testament not to Deep Capture, but to the deadly seriousness of the crimes that we seek to expose.

* * * * * * * *

Repost, but I think it is important to understand history. This guy owned a car company, stood up to naked shorting 89 years ago and lost, bankrupted to the Wallstreet Mob. NYSE bragged that no court ever overturned their decisions and that they ran the country.

Is anyone familiar with the Stutz Motor Car company? The shorts tried to drive his company out of business because they could smell blood as competitors went to assembly lines, but Alan Aloysius Ryan stood firm, hitting every share with a buy.

Suddenly, one day in 1920, he announced to the world that he owned 105% of the outstanding shares and that he wanted the sellers to deliver him his shares.

The clearing brokerages stood to be bankrupted as they stood as the middle men who facilitated the short sales, even though there weren’t enough shares to deliver.

The NYSE decided to protect their own, even setting up a “protective committee” to protect their members. Despite the threat of criminal proceedings, they delisted the company and set the price that Ryan had to sell the naked shorts shares at. The price was far below the highest price he paid to buy the shares in his own company. They banned the private sales he tried to set up with shorts anxious to cover at $500 – $1,000 per share (stock traded $391 before being delisted), because they said he couldn’t do a private sale when sales were halted.

The exchange argued that they were above any court and they charged Ryan with “conduct or proceeding inconsistent with just and equitable principles of trade”. His crime? Asking for the sellers to deliver what they sold to him. He complained that the governors of the NYSE exchange were the same people naked shorting his company and it was unfair for them to act as judge and jury. He tried to quit the exchange and they said he couldn’t quit because he was under investigation.

The company was under pressure from creditors and much of the stock he bought and that had to sell at a lower price was bought on credit. His debts got intertwined with the debts of the company and he and the company went bankrupt. The same groups that lent him money were able to collapse him into bankruptcy as the shares he provided as collateral, which no longer traded had no collateral value. He was forced to sell the stock at 2% of the high price he paid for it.

Looking with the benefit of history, you can’t help if there was a conspiracy against him by competitors, creditors and naked shorts, all from the same group, that saw great value in getting rid of a privately controlled competitor. You also wonder if this was already happening in 1920, how much more savvy and powerful the families that control Wallstreet have become in the intervening 89 years.

http://query.nytimes.com/mem/archive-free/pdf?res=9806E5D81131E03ABC4953DFB266838B639EDE

http://query.nytimes.com/mem/archive-free/pdf?_r=1&res=9B03E0D71131E03ABC4E53DFB266838B639EDE

http://query.nytimes.com/mem/archive-free/pdf?res=9507EEDD1E31E03ABC4C52DFB266838B639EDE

http://query.nytimes.com/mem/archive-free/pdf?res=9404E6DB133FE432A25754C1A9629C946195D6CF

http://query.nytimes.com/mem/archive-free/pdf?res=9C03EFDB133AE03ABC4952DFB066838B639EDE

http://query.nytimes.com/mem/archive-free/pdf?res=9B06E6DD1130EE3ABC4152DFB7668389639EDE

http://query.nytimes.com/mem/archive-free/pdf?res=9C03E7DA1639EE3ABC4C51DFB066838B639EDE

http://query.nytimes.com/mem/archive-free/pdf?res=9F0CEED91E3EEE3ABC4951DFB7678389639EDE

Here is an older two-part article about the compromised media… Miss Money Honey is given the full treatment by Pam Martens.

http://www.counterpunch.org/martens01272007.html

“The real story, in my view, is that as far back as 2002, when Sandy Weill controlled Citigroup with an iron fist and Chuck Prince was his top lieutenant, Ms. Bartiromo was not sounding very much like an impartial journalist on the back jacket of “King Of Capital: Sandy Weill and the Making of Citigroup.” Here’s what she said about a man who was about to explode in the news as the kingpin of one of the most corrupt businesses on Wall Street: “Sandy Weill is probably the best deal maker on the planet. He is truly one of the leading business titans of our times.”

http://www.counterpunch.org/martens02022007.html

“Despite the fact that CNBC is a news organization and is well aware that the Citigroup Private Bank was kicked out of Japan for money laundering and other fraudulent activity, that Citigroup has been charged with racketeering, market manipulation, fraudulent research, rigging the European bond market, and aiding and abetting in the collapse of Enron and WorldCom, there is no mention of that on its co-branding press release.”

I love the guy with the dayglo sign. Our numbers keep growing as the government continues to lie and twist.. Call your reps to support HR 1207… Audit the Fed. Remember it is the Fed banks who control the DTCC.

Further to Mary’s plea, think of a game of poker. Over time, one player gets all the chips as he’s the winner and the losers can’t play any more.

Either:

1. The game comes to a halt

2. People are allowed to buy in

Under the Federal Reserve System, the only way you can buy in is to borrow as that’s the only way new money is created. Only the principal is created, so the system is always short the interest, so borrowing from one year to the next has to always increase.

If everyone paid off all their loans, there would be no money in circulation because the Federal Reserve requires money to be created out of thin air.

We have private banking families that control markets that trade supply and demand of chits instead of supply and demand of the real item and who can print money out of thin air by lending computer entries to the tax payer who think they are above the law.

The newspaper article from 1920, above, where the NYSE bragged that no court ever overturns their rules, even if they are unconstitutional is chilling. These banksters think they are smarter than us and they think they can run the country forever.

People are angry, but their anger is getting misdirected to Fox News sponsored tea parties.

We need to focus people on changes they can make that matters and supporting HR 1207… is one that matters.

I’d take it one step further, then an audit, though.

ABOLISH THE FED

ABOLISH THE DTCC

Arrest anyone who misrepresents that they have an asset held in trust when they do not.

because the Federal Reserve requires money to be created out of thin air.

should be

because the Federal Reserve requires borrowing for money to be created out of thin air.

… and it’s Ginger.

Dr. Jim DeCosta,

You stated:

“Securities scholars argue as to whether a “loan” from the SBPs “lending pool” that involves the transference of “legal ownership” is a “loan” or a “sale”. The DTCC argues vehemently that it is a “loan” and therefore they have the right to credit the account of the “lender” with a “long position”/”securities entitlement” to denote his “right” to call in the “loan”. If it were characterized as a “sale” because of the transfer of ownership then the DTCC would have no right to credit the donor firm with a “securities entitlement”.”

Interesting…. Here are some thoughts that came to mind while reading this paragraph………….

Yesterday as I was writing the first draft of the WALL STREET PONZI SCHEME, I noted in my mind and in the text that the BUYER’s brokerage statement says he is long xxxx shares, even though HIS MONEY was NEVER USED to buy long shares…. His Money was placed in an interest-bearing-account.

By calling the shares used to cure the FTD a LOAN, the DTCC can allow the BUYER’s Money to remain in an interest-bearing-account so the Wall Street Criminals can divert this money into their pockets. The use of the word “LOAN” also allows the Wall Street Criminals to counterfeit more and more shares to drive the stock price down, which then gives them the ability to steal the BUYER’s money.

On the other hand, IF the DTCC referred to the shares used to cure FTDs as a “SALE,” then the money in the interest-bearing-account would have to be transferred to the firm SELLING the shares to the BUYER.

So it appears that the use of the word “LOAN” enables the WALL STREET COUNTERFEIT MACHINE to operate efficiently – creates the greatest amount of income for the Wall Street Criminals – allows the Criminals to leverage the BUYER’s money to its greatest extent.

On the other hand, the use of the word “SALE” might cripple or prevent the WALL STREET COUNTERFEIT MACHINE from operating.

iStandup, it is important to note that what is transferred from the SBP is only a claim on ownership rather than actual ownership.

The actual ownership is always immobilized with the mysterious private partnership the DTC uses as a nominee which has been in existence since at least 1971 (Cede & Co.).

Cede & Co. is the ACTUAL REGISTERED OWNER of those shares unless you pull your certificate.

I noticed that in 1999-2000, as shares that used to be registered to individual banks and brokerages began to be registered to Cede & Co., that that process coincided nicely with the formation of the DTCC and a sudden astronomical increase in naked shorting and a sudden crash of the dot com boom.

Sean,

In the article you quoted about Bernie Madoff, it stated:

“What is not in dispute is that, to the Journal’s eternal shame, the story eventually came out only after an avalanche of redemptions left Bernie with nowhere to hide and he turned himself in. In the interim, by remaining silent, the Journal played a devastatingly ignominious role in one of the biggest and most brazen scams in history.”

More specifically:

” the story eventually came out only after an avalanche of redemptions left Bernie with nowhere to hide and he turned himself in.”

It seems to me that in regard to the PONZI SCHEME the Wall Criminals have created called:

“Abusive Naked Shorting Counterfeit Selling,”

the only way there would be an “avalanche of redemptions” is if forced “buy ins” would occur.

Since the Wall Street Criminals control the Clearance and Settlement System, they make sure forced “buy ins” DO NOT occur.

And of course, Since the SEC has been captured by these criminals, the SEC leaders make sure forced “buy ins” DO NOT occur.

This Wall Street Ponzi Scheme is beginning to make more sense….

Abusive Naked Short Counterfeit Selling

Soros, through his MoveOn org, trying to destroy the Bank of America to collect on his short bet:

http://messages.finance.yahoo.com/Stocks_(A_to_Z)/Stocks_B/threadview?m=tm&bn=1903&tid=864911&mid=864911&tof=7&frt=2

Sadly predictable.

Here’s a snip-it from a paper I’ve been asked to do. Trust me when I say that EDUCATION is the key to ending this crime wave. The securities fraudsters are simply leveraging their superior working knowledge of how our clearance and settlement system works (or fails to work).

KEY CONCEPTS OF ABUSIVE NAKED SHORT SELLING (ANSS) CRIMES

1) All failures to deliver (FTDs) securities result in the granting of “security entitlements”/IOUs. This includes those theoretically “cured” by an NSCC “Stock Borrow Program” (SBP) borrow.

2) The phraseology used in UCC-8 converts “security entitlements”/IOUs into an odd species of readily sellable but invisible “phantom shares” paradoxically with no technical “legal owner” and that technically are not “outstanding”.

3) These “phantom shares”/”security entitlements” get issued BEFORE the “legitimacy” of the delivery failure that created them can be determined.

4) By the time the delivery failure can be diagnosed as illegitimate/intentional (intentionally done to drive down share prices) it’s too late for U.S. investors as the DTCC, NSCC, FINRA and the SEC have either surgically removed all of the “backstops” in place should “security entitlements” be mistakenly issued for illegitimate/intentional FTDs or have had the audacity to plead to be “powerless” in providing the cures they offer i.e. to execute “buy-ins”.

5) The two subtypes of “phantom shares” from a legitimacy point of view might be labeled “phantom shares of yet to be determined legitimacy” (aged between T+3 and perhaps T+6) and “illegitimate phantom shares” (yet to be delivered by T+7).

6) The execution of a prompt “buy-in” the moment it becomes obvious that a delivery failure was illegitimate/intentional serves as the only real deterrent to these crimes and provides the only cure for the delivery failure when the seller of securities absolutely refuses to deliver them VOLUNTARILY.

7) Due to the phraseology “securities held long” used on monthly brokerage statements the defrauded investors with the most incentive to follow up on delivery failures don’t even realize that they’ve been defrauded. They don’t realize that “long positions”/”securities entitlements” result from delivery failures.

8) The U.S. investors are naïve enough to believe that there are UNCONFLICTED SROs and UNCONFLICTED regulators there to provide investor protection. The recent scathing report of the SEC’s Inspector General summarily dismisses this theory.

9) With the phraseology used in UCC-8-501 regarding the mandated issuance of what amount to be “phantom shares” while being aware of their share price depressant effect an UNCONFLICTED SRO or UNCONFLICTED regulator would set alarms and have whistles going off with each and every delivery failure that occurs.

10) Prompt “Buy-ins” by unconflicted SROs and regulators would be fast and furious with each FTD attaining an age of perhaps T+6.

11) These thefts associated with abusive naked short selling cannot occur without direct FACILITATION by the “securities cops” going well out of their way to remove the congressionally mandated sources of deterrence to these crimes and only cure available when the sellers of securities refuse to deliver that which they sold i.e. refuse to execute “buy-ins”. CONFLICTED SROs and CONFLICTED regulators are needed to actively refuse to enforce various securities laws including 15c3-3, 15c6-1, Section 17A and dozens of others.

12) When the victims of these frauds find it necessary to sue the NSCC and its abusive clearing firms for ANSS frauds the SEC will predictably appear with an amicus curiae brief stating that these clearing firms were FORCED to credit those accounts of investors with “securities entitlements”/”phantom shares” as per 8-501. They’ll claim that there is no such thing as a “phantom share” and that since the number of shares TECHNICALLY “outstanding” in that corporation doesn’t increase then no damages can be done to a corporation (by crooks flooding its share structure with readily sellable “securities entitlements” resulting from FTDs). The judges typically fall for this ruse.

13) Unless UCC-8 is rewritten then the only solution possible is to not allow FTDs to occur in the first place. This is also referred to as “mandated pre-borrows” wherein the seller of shares whether labeling his sell order “long sale” or “short sale” cannot execute the sale UNTIL the shares being sold are in place and ready for delivery on “settlement date”.

14) Any inadvertent FTD falling through the cracks would then be bought-in upon discovery.

15) In abusive naked short selling (ANSS) crimes the mere method of placing the “short” bet enhances the prognosis for the success of the bet i.e. the game is “rigged” in favor of those able to easily establish massive naked short positions. Securities fraudsters can convert the normal share price buoying effect of buy orders into share price depressing readily sellable “security entitlements” by simply refusing to deliver the shares they sell into those buy orders. Thus both buy and sell orders drive share prices down due to the combination of refusing to deliver that which you sell plus the phraseology used in UCC 8-501. There can be no clearer example of a “rigged” market than one in which BOTH buy and sell orders drive share prices downwards.

16) The playing field becomes tipped in favor of the FINRA members, the DTCC “participants” and their hedge fund “guests” willing to supply vast amounts of “order flow” to abusive market makers willing to be the most “accommodating” to the financial interests of these politically well-connected “banksters”/financial oligarchs i.e. willing to prostitute their access to the universally abused bona fide market maker exemption.

17) The combination of the ease these “banksters” have in establishing massive naked short positions with no fear of being bought-in by their employees (the NSCC management) when combined with this market “rigging” ability results in the current “us versus them” stalemate on Wall Street wherein the desires of financially unsophisticated investors needing “investor protection” in a complex Wall Street setting conflict with those financially sophisticated “securities cops” (FINRA “members”, DTCC “participants” and certain SEC staff members) congressionally mandated to provide “investor protection”.

18) When the “securities cops” congressionally mandated to provide “investor protection” actually serve as the “prime facilitators” of these crimes and the investors with the most motivation to fight this crime wave don’t even know that they have been defrauded then that leaves nobody left to look after the needs of the investors. It also helps explain the unconscionable research findings of the SEC’s Inspector General that revealed that of the over 5,000 complaints the “securities cop” known as the SEC Enforcement Division received on abusive naked short selling abuses NOT ONE resulted in an “enforcement action” and that of the over 900 recommendations for enforcement actions made by the “securities cop” known as “FINRA” NOT ONE was related to abusive naked short selling.

I’ve been working on the elevator pitch to try and keep it understandable (and believable) to people.

“If you buy purchase a victim stock, your own brokerage and a crooked seller will conspire to take 100% of your investment money. The way it works is that your brokerage doesn’t demand a real share from the seller and you’re none the wiser because they list the share on your statement to make you think it has been delivered. Unless you ask for your share certificate, you’re unlikely to know you’ve been conned.

For their participation, your brokerage gets to keep all the interest on your money until your investment goes to zero. In the mean time, since the crooked seller doesn’t have to deliver anything, they hit every bid with an offer (supply is unlimited) until they collapse the share price and bankrupt the company. At that point, your brokerage transfers 100% of your purchase money to the seller, who still hasn’t delivered anything. The crooked seller doesn’t even pay capital gains income tax as technically, the transaction has never closed as they haven’t delivered a share.

Sometimes your own brokerage is the crooked seller and sometimes they are the buyer collecting interest, but the one thing that remains the same is America’s retirement savings are being sucked offshore by this con game.

The perverse thing as that at first the crooked seller has to put up some of their own money as collateral, but as the share price begins to collapse under the weight of all the counterfeiting, they are able to withdraw their own money and investor funds as the required collateral becomes less and less.

The regulators have mostly been bought by the trillions this crime generates and the complexity and brazeness of it makes most politicians yawn in disbelief. They turn to bought experts to explain it to them.

It can’t be easily investigated, because the crime crosses both state and international boundaries, outside the jurisdiction of police and local securities regulators.

The only way this will stop is if I can explain it to you and you can in turn explain it to your friends until every investor understands exactly how their own brokerage has had a hand in their wallets.”

Nice picture. Anger against Wall Street is palpable, it’s in the air. It’s in the main stream media.

If a ballot initiative were held today, it would pass for sure. So I think it’s time for another try.

The reason the motor company in the 1920’s could be dictated to was because there were no securities acts yet. But they exist now and they reserved certain areas of securities regulation to the states. That is why Wall Street succeeded in having the states adopt the UCC.

Time to amend the UCC via a ballot initiative.

From: Grant Atkins

Sent: Monday, July 21, 2003 4:01 PM

To: Ginger

Subject: GeneMax Corp.

You are on the unfortunate side of what I believe is a multi-trillion US dollar problem – so large that it is on the verge of sending the US economy into recession. If you check GeneMax Corp.’s press releases back to July 2002, the Company has started litigation in three countries suing most of Wall Street over the epidemic of “naked short selling” that exists since the US’s 3-day securities settlement system only applies to the payment side of the transaction and the share delivery side is routinely never delivered. The result is banks, brokerages, market makers, and hedge funds that sell non-existent securities and the NASD, SEC, and all other regulating bodies allow it to go on. The investor is none the wiser unless they attempt to actually obtain delivery of what they purchased. The broker statement you get only indicates what the broker said he purchased for you, and they say you can buy and sell it anytime, and they will sell those non-existent securities for you any time you wish, but the securities you actually thought you bought are not really there a lot of the time – it is all a big fraud on the investor. Our litigation and those of other companies that include AMEX, NASDAQ, and NYSE exchange companies show how large the dynamic really is. All you can do that I believe is effective is complain to the SEC in writing and demand a response, or sue your broker in small claims court. The SEC will not do anything but may if many others also complain. The suit will cost you little, and cost the brokerage everything. They will find you stock in short order. They know they have no defense to not providing what they contracted with you for.

I am available for further discussion per the contact numbers below. The further response you got from TD Waterhouse regarding “certificate only” reasoning is from the entity that is perpetrating fraud on you. I would not expect the answer to be correct.

GeneMax Corp.

Grant Atkins, CFO, Director

We need more “elevator pitch”, as Anon above. Something that will get attention. Keep harping on it. Most people think it’s too kooky when they first hear it. People don’t understand how serious the problem is.

DavidN,

From your post #1, it is clear that the Wall Street Abusive Naked Short PONZI SCHEME is not new. It goes back at least to the 1920s! (The links you supplied no longer work – they are for members only today)

I suppose what is new – is that the Wall Street Abusive Naked Short PONZI SCHEME was re-introduced under the nose of the past SECs and is now protected by the supposed “Wall Street Cops” – the SEC and NCSS.

To understand share counterfeiting, you need to understand the private creation of money.

http://media.www.eaglenews.org/media/storage/paper1344/news/2009/04/08/Opinion/Americas.Money.Story-3703728.shtml

The links still work for me. Does anyone else have a problem?

That story in my first post needs to be a Deep Capture feature. The fact that this crime was being hatched as early as 1920 explains why it is so difficult to defeat now. Generations have been habituated to believe it’s just the way things are.

Tommy, the 1930’s security regulations give us tools, but they need to be enforced. I agree the states are the answer and UCC a current problem.

Another possible answer is the bank for international settlements, which “regulates” the DTCC and Wallstreet internationally for Geneva.

In my mind, the biggest solution will be to wake the average investor up, so they understand how the crime works. They are receptive, looking for the enemy with their tea parties, but don’t understand how they are being stolen from yet.

It’s not just stocks that are counterfeited. They have the nerve to raise debt money, then naked short into the offering, forcing the municipal, state or federal taxpayer to pay more interest, while they are able to borrow money at low interest, with no collateral from investors that think they are investing in a government bond.

They also do this with commodities, so the farmer that can’t pay his bills and doesn’t understand why grain is so cheap goes out of business or the mine that produces bullion has to close because it isn’t profitable.

The whole system is based on supply and demand of chits instead of supply and demand of the real thing.

DavidN,

I should have noted that I am sent to a screen asking me to Sign Up for a Free subscription…. whereas, the other day I was not asked to do this.

Why does this story peak my curiousity so??

Ex-Fed Employee, Brother Arrested In ID Theft Scheme

April 24, 2009

(Updates with additional details, New York Fed comment.)

By Chad Bray

Of DOW JONES NEWSWIRES

NEW YORK -(Dow Jones)- A former information/technical analyst at the Federal Reserve Bank of New York and his brother were arrested Friday in an alleged identity theft scheme.

Curtis L. Wiltshire, who was terminated by the New York Fed in February, has been charged in a three-count complaint with bank fraud, fraud in connection with identification documents and aggravated identity theft, while his brother, Kenneth Wiltshire, has been separately charged with mail fraud and aggravated identity theft.

The bank fraud charge carries up to 30 years in prison and the mail fraud charge carries up to 20 years in prison. The identity theft charge carries mandatory minimum of two years in prison and must be imposed consecutively to any other sentence the men may receive if convicted.

The men are expected to appear before a U.S. magistrate judge in Manhattan later Friday.

Lawyers for Curtis and Kenneth Wiltshire didn’t immediately return phone calls seeking comment Friday.

According to the charging document, Curtis Wiltshire, 34 years old, of Staten Island, had access to computer files containing personal information about employees at the New York Fed, including their names, dates of birth, Social Security numbers and photographs.

On Feb. 15, Curtis Wiltshire was escorted from his workstation and interviewed by a Fed investigator regarding conduct unrelated to the charges, according to the complaint. He was terminated shortly after the interview.

A portable storage thumb drive was found connected to his computer at the time.

Prosecutors have alleged the thumb drive contained information related to fraudulent student loans purportedly taken out in late 2006 for attendance at Sarah Lawrence College and Vassar College using the identities of two persons who never attended those colleges. The loans were valued at about $73,000.

The thumb drive included an account statement from Sarah Lawrence in the name of one victim and an image of a check payable to that victim, an image of the Maryland driver’s license of another victim and a completed student loan application in the other victim’s name.

According to court documents, prosecutors have separately alleged that the brother, Kenneth Wiltshire, 40, of Brooklyn, was witnessed in October 2008 by a U.S. postal inspector picking up a parcel at a mail box reportedly used in an identity theft scheme. The parcel included loan documents for the purchase of a 2006 Sea Ray 340 Sundancer boat.

The loan was taken out in the name of an individual living in Brooklyn who had never applied for the boat loan and was a victim of identity theft, the government said.

Kenneth Wiltshire was later witnessed by the postal inspector purchasing three money orders that were sent back to the marine finance company with the executed loan documents and the copy of a counterfeit driver’s license with the victim’s information and the photograph of a former Fed employee, prosecutors said.

Another counterfeit driver’s license with the photo of another Fed employee also was found in the mail box in October, the government said.

“We’re aware of the case and cooperating fully with the U.S. Attorney’s office,” said Deborah Kilroe, a spokeswoman for the New York Fed.

http://www.nasdaq.com/aspx/stock-market-….id-theft-scheme

I just discovered the SECSecurities and Exchange Commission Historical Society website – http://www.sechistorical.org.

I searched for Naked and found two documents.

Here is a paragraph from 1977 where “Naked Shorting” is mentioned:

“A principal strategy available to all such participants is the ability to generate additional income through premiums by the writing of options; this may be accomplished either by writing on long stock positions or writing naked ( “shorting” the option). Another principal strategy is that of hedging equity stock positions by offsetting (i.e. , “opposite side” ) positions in the standardized options. Both of the foregoing involve transferring to the options market some or all of the risk of holding a position in the underlying equity security. Hedging may also entail reducing risks on an options position by assuming offsetting options positions through so-called spreading transactions. And, of course, options are used as a highly leveraged, market instrument to speculate in potential price movements of the underlying equity security. Further, there is the strategy of arbitraging between options series of different expiration periods and striking prices and between options and the underlying security. However, the execution costs associated with arbitrage effectively limits that strategy to traders and market makers.”

( http://www.sechistorical.org/collection/papers/1970/1977_0128_SEC_MIC_material.pdf )

Speech by SEC Chairman:

Address to the Council of Institutional Investors

by

Chairman Mary L. Schapiro

U.S. Securities and Exchange Commission

Council of Institutional Investors — Spring 2009 Meeting

Washington, D.C.

April 6, 2009

( http://www.sec.gov/news/speech/2009/spch040609mls.htm )

Mary uses some beautiful words about the SEC, such as – “We are the investor’s advocate.”

I would like to ask Mary WHY she and the other SEC commissioners “stonewalled” seven United States Senator who wrote her a letter on April 2nd asking her to address “Abusive Manipulative Naked Short Selling” at the SEC meeting on April 8th?

The press summary of their meeting on April 8th does NOT MENTION the words “NAKED SHORT” one single time. Here is their press release:

ww.sec.gov/news/press/2009/2009-76.htm

So Mary wants us to believe the SEC is the “investor’s advocate,” but refused to talk about “Abusive Manipulative Naked Short Selling” at their meeting?

Mary we need actions from you against “Abusive Manipulative Naked Short Selling” to prove you indeed are “the investor’s advocate.”

standup……. You merely have to understand that little mary views the ones manipulating our markets as the only “investors” that require “protecting”. This is how the s.i.c. shills justify the whoring of themselves, and their powers, to the criminals.

Ms. Bartiromo’s accolade of ‘business titan’ goes to the highest bidder.

She’s a prostitute among business ‘journalists’.

Read again folks.. more details this time

SUNDAY, APRIL 19, 2009

LEAKED! Bank Stress Test Reults !

The Turner Radio Network has obtained “stress test” results for the top 19 Banks in the USA.

The stress tests were conducted to determine how well, if at all, the top 19 banks in the USA could withstand further or future economic hardship.

When the tests were completed, regulators within the Treasury and inside the Federal Reserve began bickering with each other as to whether or not the test results should be made public. That bickering continues to this very day as evidenced by this “main stream media” report.

The Turner Radio Network has obtained the stress test results. They are very bad. The most salient points from the stress tests appear below.

1) Of the top nineteen (19) banks in the nation, sixteen (16) are already technically insolvent.

2) Of the 16 banks that are already technically insolvent, not even one can withstand any disruption of cash flow at all or any further deterioration in non-paying loans.

3) If any two of the 16 insolvent banks go under, they will totally wipe out all remaining FDIC insurance funding.

4) Of the top 19 banks in the nation, the top five (5) largest banks are under capitalized so dangerously, there is serious doubt about their ability to continue as ongoing businesses.

5) Five large U.S. banks have credit exposure related to their derivatives trading that exceeds their capital, with four in particular – JPMorgan Chase, Goldman Sachs, HSBC Bank America and Citibank – taking especially large risks.

6) Bank of America`s total credit exposure to derivatives was 179 percent of its risk-based capital; Citibank`s was 278 percent; JPMorgan Chase`s, 382 percent; and HSBC America`s, 550 percent. It gets even worse: Goldman Sachs began reporting as a commercial bank, revealing an alarming total credit exposure of 1,056 percent, or more than ten times its capital!

7) Not only are there serious questions about whether or not JPMorgan Chase, Goldman Sachs,Citibank, Wells Fargo, Sun Trust Bank, HSBC Bank USA, can continue in business, more than 1,800 regional and smaller institutions are at risk of failure despite government bailouts!

The debt crisis is much greater than the government has reported. The FDIC`s “Problem List” of troubled banks includes 252 institutions with assets of $159 billion. 1,816 banks and thrifts are at risk of failure, with total assets of $4.67 trillion, compared to 1,568 institutions, with $2.32 trillion in total assets in prior quarter.

Put bluntly, the entire US Banking System is in complete and total collapse.

Bonifides

For those who may be skeptical about the veracity of the stress test report above, be reminded that only last Sunday, April 12, this radio network obtained and published a Department of Homeland Security (DHS) Memo outlining their concerns that returning US military vets posed a domestic security threat as “right wing extremists.” That memo, available here, is marked “FOR OFFICIAL USE ONLY” and contained strict warnings that it was not to be released to the public or to the media. We obtained it and published it days before other media outlets.

Details of certain aspects of the stress test reported above have now been CONFIRMED through REUTERS News service when they disclosed the risk-capital percentages publicly on April 6, 2009 at this link

Further, todays Wall Street Journal (April 20, 2009) is confirming at this link that lending by the largest banks has DECREASED 23% since the government began the T.A.R.P. program, causing many in Congress to ask where the money has actually been going. Apparently, it has been going into propping-up the failing banks instead of out in loans to the public.

Additional details and proofs are forthcoming. . . . . continue to check back on this developing story.

UPDATE 1154 HRS EDT April 20, 2009 —

The United States Treasury has openly and brazenly lied regarding our stress test report and we can prove they have lied about it.

This morning, the United States Treasury issued a statement (HERE) claiming they do not yet have the results of the Stress Tests, rebuking our report

How do we know its a lie?

Because of this from April 10th:

April 10 (Bloomberg) — The U.S. Federal Reserve has told Goldman Sachs Group Inc., Citigroup Inc. and other banks to keep mum on the results of “stress tests” that will gauge their ability to weather the recession, people familiar with the matter said.

The Fed wants to ensure that the report cards don’t leak during earnings conference calls scheduled for this month. Such a scenario might push stock prices lower for banks perceived as weak and interfere with the government’s plan to release the results in an orderly fashion later this month.

How can you be ordered not to release something you don’t have?

Since that was published on the 10th of April, we therefore know that the results exist and Treasury, the banks involved and The Fed have them, as The Fed was concerned that some banks might try to use them (perhaps in a misleading fashion) during their first quarter conference calls and earnings releases.

Sorry guys, but whether the Turner Radio Network has the real results or not is no longer material. What’s material is the claim that Treasury doesn’t have them, since they told the banks on the 10th not to release them, and you can’t release what you don’t have.

The problem with lying is that eventually you forget your previous lies and thus get caught when you contradict yourself.

http://turnerradionetwork.blogspot.com/

Would someone kindly explainif and how this benefits us??

ICE Begins Clearing Live Credit Derivatives Trades

« Result #1 Yesterday at 9:54pm »

——————————————————————————–

ICE Begins Clearing Live Credit Derivatives Trades

April 24, 2009, 03:44 PM ET

CHICAGO -(Dow Jones)- IntercontinentalExchange Inc. (ICE) this week began clearing live credit default swap transactions, a key step toward mitigating systemic risk in the $28 trillion market.

The move comes as ICE Trust, the credit derivatives clearinghouse launched by the Atlanta-based exchange in early March, crossed the $100 billion threshold in notional value of trades cleared.

ICE Trust remains the only clearinghouse for credit derivatives in the U.S. and the only such platform to do any business on either side of the Atlantic.

Chicago-based CME Group Inc. (CME) is readying its own CDS clearing and trading solution, a joint venture with the hedge-fund firm Citadel Investment Group, though no launch date has been set.

NYSE Euronext (NYX) rolled out its own clearing platform for credit derivatives in London last December, but, as of this month, that service had yet to handle any trades.

Up until this week, ICE Trust had been clearing pre-existing trades, as dealer banks backloaded positions into the clearinghouse.

Credit default swap indexes remain the only sort of credit derivatives clearable through ICE Trust, though ICE plans to eventually expand clearing capabilities to single-name instruments.

Authorities in the United States and Europe have pushed CDS dealers to clear credit derivatives trades, in a bid to improve efficiency and reduce the systemic risks exposed by the near-collapse of American International Group Inc. (AIG) last fall.

http://money.cnn.com/news/newsfeeds/arti….06_FORTUNE5.htm

This seems as good a place as any… I seem to have had my yahoo finance message board (GMO & TC) posting privileges revoked for posting too much ‘radical’ market reform content methinks… For the past few days whenever I’ve tried to post a response to the pumper/dumpers on a few different stock message boards, I am unable to do so, getting a ‘999’ error code. I googled this & it seems others are experiencing the same (censorship) in various yahoo finance message boards. I found thru google that someone else has reported the exact same censorship issue on the Dupont board for the same behavior (posting in regard to market reform). Others, per my google search, have reported that google is also restricting allowable content as they see fit. This really peaves me since this effectively lets the board manipulators operate without any dissenting viewpoints. I think there may be fodder for a future story…

If anyone cares to go pick a fight or you are just curious, by all means please go to one of these message boards (GMO and/or TC) and post something, please be sure to include a http://www.deepcapture.com link at the end of your post. I don’t think they can turn your access off until you’ve posted & deemed your content unacceptable. It would be awesome if a few hundred unique posters all linked to deepcapture ended up on these boards. I think that would really freak out the cheats! The boards I’ve been banished from are for GMO & TC…

Anybody game for causing some trouble?

Saturday, May 2, 2009

Soon to be Published.

You don’t have to be an investor to be curious about what goes on behind the scenes in the financial markets. All the terms bantered about describing causes for our economic collapse are camouflage for the real underlying problem. The “bailout” which has become “bailouts” with a big S is one giant “short covering.”

If you are a CEO, it is your fiduciary responsibility to know this subject.

If you are a Broker and you don’t already know this, then you are shortchanging your clients.

If you are an Investor, this book will answer your questions about naked short selling.

If you are a Naked Short Seller – know that we’re educating an army.

Naked Short Selling is the reason behind the destruction of wealth in our country undermining everything from pension funds to bank solvency.

http://nakedshortsellinganditsabuse.blogspot.com/