My intent in this piece is not to ask whether or not employees of the SEC trade on inside information.

That’s easy: they do. This fact has been documented by finance academics and published in peer-reviewed academic journals. For example, in “Stock Trades of Securities and Exchange Commission (SEC) Employees”, Journal of Law and Economics (2017), authors Shivarum Rajgopal (Columbia Business School) and Roger White (Arizona State University) summarize their findings:

“We examine the profitability of stock trades executed by SEC employees… [W]e find that a hedge portfolio mimicking such trades earns a positive abnormal return of about 8.5% per year in U.S. stocks…” (emphasis added)

Thus, we can consider two choices:

- “The average SEC employee who invests in the stock market is about as good a stock-picker as Warren Buffett”;

- “The average SEC employee who invests in the stock market trades on inside information.”

Given those options, I dare to write: “The average SEC employee who invests in the stock market trades on inside information. QED”

Thus, again, my question is not whether employees of the SEC trade on inside information, as I consider that a settled matter. Instead, the meaning of the title of this piece is this: Imagine a situation where the SEC leaks inside information regarding its regulatory intentions towards a company, and does so only to select clients (where, per “The Theory of Economic Regulation” [Stigler, 1971]) the SEC’s “clients” are understood to be bulge-bracket Wall Street prime brokers, and not you, the taxpayer). Is it then Material Non-Public Information?

Fortunately, we have a test case at hand: recent events regarding OSTK and OSTKO.

Followers of Overstock know that the firm recently attempted to issue a dividend. There were ≈ 37 million shares of OSTK. It had another class of stock (OSTKO) trading on a blockchain ATS owned by tZERO, a subsidiary held 82% by Overstock. On July 30 (while I was CEO) it announced a dividend of 3.7 million OSTKO tokens to be issued on a 1-for-10 basis to the holders of its 37 million OSTK shares.

In the universe which I inhabit, nothing seems odd about those numbers: 37 million X 1/10 = 3.7 million. Yes, the advanced mathematics checks out.

The outside legal counsel for these matters was the fine firm of Bryan Cave, led by the able Cliff Stricklin. Cliff is a former federal prosecutor, a state judge in Texas, a federal prosecutor who was specially tasked with the Enron prosecution, and finally, in private practice, generally considered the nation’s foremost authority on white collar crime. He had his most able securities partner handling this matter while he oversaw it. I believe the dividend was legally about as buttoned up as it could be.

In the warped universe of Wall Street, this dividend risked exposing the bezzle in their system. As this website has long maintained, our National Market System’s settlement plumbing is so full of flaws that no one really knows how many people own how many shares of publicly traded corporations in the United States. This was ably demonstrated by the famous Dole Foods litigation, where a company that had issued ≈ 37 million shares (coincidentally, roughly the same as OSTK) turned out to have shareholders who “legitimately” owned ≈ 50 million shares (I say “legitimately” because the Delaware courts found that there was no way to say which of them were “legitimate” and which “illegitimate”: see “Dole Foods Had Too Many Shares”, Bloomberg, 2017).

I did have a concern: this dividend could expose the crooked world of Wall Street settlement. That is because no one really knew how many shares of Overstock that the firm’s “shareholders” own. The firm had issued 37 million. There were also 18 million officially short. The firm was also on the Reg SHO threshold list, which means that there were some additional number of unsettled trades (in other words, slop in the settlement system creating an artificial supply of outstanding shares). In addition, there is a procedure called “ex-clearing” by which the phantom stock created by unsettled trades among brokers gets converted into derivatives called “Contracts For Difference” among the brokers, and no one in the marketplace (least of all the SEC) can tell how many phantom shares have been transmuted that way. In addition, there are knowledgeable people who have told me that every share legitimately shorted may be “daisy-chained” into one or more hidden shorts. For long-term students of Deep Capture this is old news, but to newcomers, I suggest you view this: “DeepCapture – The Movie”).

The result is a pig’s breakfast which the SEC oversees and refuses to do anything about, unless they are providing concierge treatment for bulge bracket Wall Street banks by whom they wish to be hired. For example, in 2008 they issued a press release that sounded encouraging: “SEC Enhances Investor Protections Against Naked Short Selling”. Pretty as their title sounded, however, their actual emergency order showed that they had decided to ring-fence the nation’s 19 systemically important banks from this phenomenon, thus protecting precisely those market participants who engage in and facilitate the practice against other public firms. Truly, that happened.

Thus this past summer no one could tell how many shares Overstock shareholders believed they owned. At least 37 million + 18 million = 55 million, but given Reg SHO, ex-clearing, and daisy-chaining, it could have been 60 million, 70 million, it could have been 100 million. No one knows any more than the Delaware courts could get to the bottom of who owned Dole Pineapple’s 37 million shares when investors could demonstrate legitimate ownership of ≈ 50 million (and Dole was nowhere nearly as heavily shorted as OSTK).

The problem with that should be obvious. If shareholders think they own 55 million, 60 million, 70 million, or 100 million shares of OSTK, given that OSTK owners were going to receive dividends of OSTKO at a 10:1 ration, shareholders would have expectations of receiving 5.5 million, 6 million, 7 million, or 10 million OSTKO shares.

And the problem with that was that Overstock was creating only 3.7 million OSTKO as blockchain–based securities (i.e., “tokens”), which is to say that they are unable to be counterfeited, as they are protected by the Gods of mathematics (Gods who cannot be corrupted due to their desire to get hired by Goldman Sachs or its law firm).

This to me this was The Great Reveal. For 15 years the SEC has responded to my contentions by claiming that short selling does not affect the price of underlying securities, and that these dynamics to which I draw attention are mythical. That being the case, the dividend Overstock was issuing, even if it forced short sellers to adjust their positions, would not affect the price of the stock. After all, if short-selling does not affect the price of an underlying security (per the received wisdom SEC economists who speak in Greek letters), why would unwinding short positions (if in fact made necessary by this dividend) affect the price of the underlying security? The logic the SEC has maintained publicly against me for lo’ these many years would imply that such a dividend should not be a problem, nor cause a ripple in the smooth function of the marketplace.

Just to be on the safe side, however, Overstock gave an unusually long period of time between the announcement and the record date: over six weeks. This was intended to allow the market time to make any adjustments, if necessary.

In moments of cynicism it occurred to me that, no matter what the laws said, no matter what the regulations said, the SEC might Bazoomba this dividend. However, I consoled myself that would be too much of a wig-slip, too much of a concession that I had been right all these years. After all, if what this dividend did was force a true-ing up of the discrepancy between what the company had issued to shareholders and what shareholders think they own, in other words, it made that slop disappear (if only momentarily), and the SEC had insisted all these years that the creation of such slop does not actually affect the price of a security (in fact, they have frequently implied that people like me who suggest otherwise are conmen), then the SEC wouldn’t be so hypocritical as to stop the dividend, would they? After years of telling these bromides to the public as their excuse for a laughably lax regulatory regime in these matters, they would not have the chutzpah to suddenly claim that while the creation of the slop does not manipulate the market, eliminating the slop does manipulate the market, would they?

They did, in fact, have precisely such chutzpah. Before I get around to that, however, I first wish to discuss some odd things that started happening in Overstock late last Spring. I am not going to point fingers (I will leave it to the SEC to dig through what they wish), but I am going to lay out some interesting facts about trading in our stock, and other oddities.

——————————————————————————————————————–

Consider a metaphor: You are looking at a pot of boiling water. The pot has a lid on it. You place your hand on the lid, holding it down, trying to prevent the pressure of the boiling water’s steam from lifting the lid off. How much strength your arm must exert is a reflection of how much pressure is building up below.

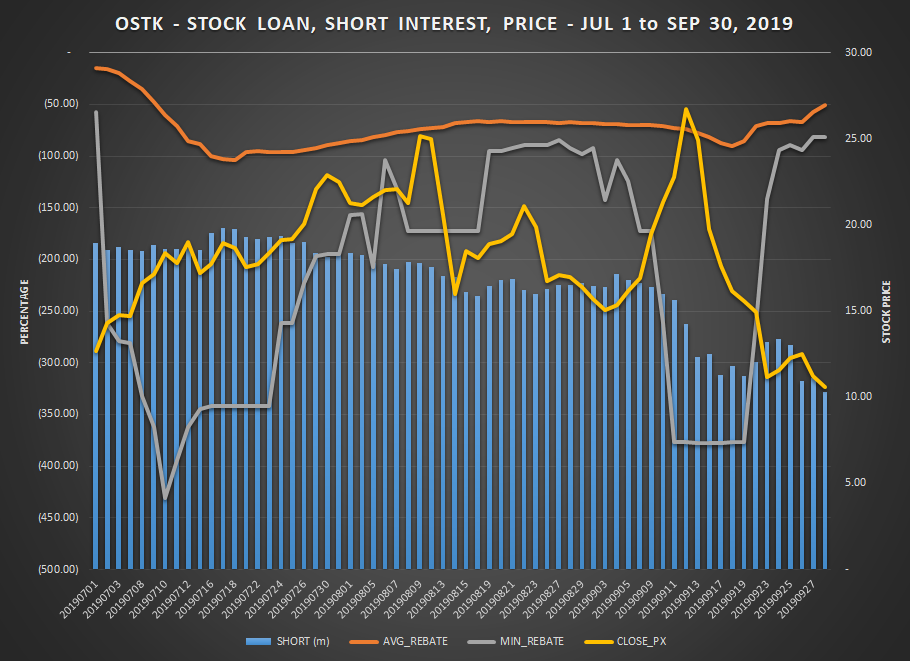

People who are short OSTK have been paying interest to maintain their short position. The technical name for that rate of interest is, “negative rebate”. I won’t explain why, but just remember the expression “negative rebate” means, “the rate of interest a short pays to maintain his short position in a heavily shorted stock.” You can think of it as a measure of, “How hard is your arm having to work to hold down the lid on the pot of boiling water?”

When I first learned about such matters, I was taught that 8% was a high negative rebate, and 12% was a disaster waiting to happen for short sellers, for it meant they were working so hard to hold it down that if they let the lid slip for an instant, the water in the pot would blast all over the ceiling. A negative rebate of 15% was considered something to tell your grandchildren about.

In recent months, how high was the negative rebate on OSTK? For the summer of 2019, the negative rebate on OSTK was running close to 100%, and there were people paying over 350% interest rates (and briefly, 430% interest rate) to keep their short positions on OSTK in place.

Incidentally, the SEC does not consider people maintaining a short position against OSTK paying interest rates of 80%, 90%, 100%, or even 430% to keep the stock from moving up, in any way manipulative. In their eyes, when it comes to OSTK, that is just a healthy marketplace functioning normally. Is that odd?

Put differently, they were struggling to keep the lid on the pot of boiling water. And if they were having to work that hard, imagine what would have happened if they had suddenly had to let go of the lid: the steam-blast might have lifted the roof.

In a stock with short positions of roughly $400 million, they were paying ≈ $400 million annually to keep their short positions in place. Over $1 million/day. Returning to the metaphor of the lid on a pot of boiling water: Think of that as someone struggling so hard to hold the lid in place, they have to move a bank safe on top of the lid to keep it from blowing.

What would have happened if they had stopped holding the lid down? How much would it have cost them? Imagine the stock did not move at all (which is to say, imagine that someone needed to place a bank safe on top of a lid on a pot of boiling water to keep that lid in place, but when they take the safe off, somehow nothing boils over: an unlikely scenario). If that happened, it would have cost them $400 million to cover their short position. So that is the bottom of the range.

However, if one must hoist a bank safe to rest on a lid over a pot of boiling water to create enough weight to keep that lid in place, then taking that bank safe off would lead (as the reader may imagine) to the water boiling over in a tremendous way. Maybe blasting a hole through the ceiling. Similarly, if the short positions in OSTK (including the 18 million “legitimate” shorts + the Reg SHO shorts + the ex-clearing shorts + daisy-chaining) had finally had to settle, the stock would have gone up just as surely as the water in the pot would have boiled over once the safe on its lid was removed. Why?

In that regard, it is interesting to mentioned something studied by an advisor-economist I keep on retainer. He was tracking information regarding the trading in OSTK, the volume, the negative rebate, and the average days outstanding of the short positions. The average duration of the short positions was important because, by counting backwards, one could use it to determine the date at which the average short position had been put in place. Short positions on margin can move 50% against their holder before triggering a margin call. Thus, if at any point the OSTK share price reached a price that it was 50% higher than the price at which the average short position had been put on (which one determined by counting backwards a number of days equal to the average duration), it would trigger margin calls, at which point the price would have become a question of what price really cleared the market for the 37 million shares we had issued (rather than what price cleared the market for the 55 million – 60 million – 70 million – 100 million shares that had been issued by the firm plus the various shares created by the National Market System’s stock settlement system).

If that happened, then as the stock price moved up, the cost to the shorts would have gone up with it. It would have thus cost more than $400 million. It might have cost $1 billion, but who knows? It could have been $2 billion. Maybe $4 billion. No idea. It would have been up to the marketplace to decide how high the stock moved to shake out enough shares from the longs holding OSTK. After 15 years of the SEC allowing this extraordinary action against OSTK (four years of which OSTK was on the SEC’s “3 day” Reg SHO list, as it was again throughout this past summer leading up to the dividend’s record date), we might finally have known what the market price of OSTK was absent such activities that caused it to be on the Reg SHO list or made short sellers pay interest rates of 90% (and a high of 300%) to keep it from moving.

I wish to note that if that had been permitted to happen, while there are those who would claim that this was deliberately created squeeze, Overstock would then have had a stock price trading at a multiple of sales merely half of what essentially all its eCommerce competitors have always had. For almost its entire history OSTK has traded at around .15X sales, versus the 2X sales its major competitors enjoy (which may seem odd, given Overstock’s record of profits and internally-funded growth the firm built over its history). If it had exploded like that, it would simply have brought the market capitalization as a multiple of sales to ≈ 1, the bottom of the range enjoyed by every competitor of Overstock in the public marketplace (even ones losing billions of dollars). As the guy running Overstock for 20 years, sipping at capital and building a profitable business while competitors who never made $1 of profit had capital dumped on them at outrageously generous terms, I was looking forward to that possibility. Rather than this being a “squeeze,” this would have merely meant that Overstock could have (at last) funded its hiring, operations, and growth from the public capital markets on terms that were merely half of the multiple enjoyed by the dozens of competitors who have come and gone and never made money.

I estimate the right answer is, “Such an event would have cost the shorts $1 billion – $2 billion”. Some would claim that it would have been much more. But the mathematical least it would have cost is $400 million (as explained above), and my sense is that it would have cost the shorts $1-$2 billion.

When one starts talking about Wall Street traders suffering a $1 billion- $2 billion loss in one event, one can imagine a lot of funny things might start going on to prevent it.

And what do you know? Some months months ago a lot of funny things did start going on within, around, and to Overstock.

=============================================================

I wish to remind readers of a point I made in other essays about my work 2005-2008 to expose Wall Street. One of my goals was figuring out the methods the crooks were using to loot the system. But when the institutions that I expected to respond failed to do so, it created a second track to my investigations. I wanted to know both what the criminals on Wall Street were up to, but also, why the political institutions in Washington as well as the financial press were not responding as until then I (naively) would have expected them to respond.

As I mentioned in a previous essay, the United States Senate Judiciary Committee was the only honest party I could find within Washington. They followed my work closely. Like me, they were interested not only in the underlying criminality going on within the Wall Street settlement system and the possibility it would lead to systemic collapse, but they were fascinated with the response (and lack thereof) I was getting from other Washington institutions. In the process of helping them sort that out I learned a valuable skill.

As has increasingly become clear to the public and which I recently revealed in full, and which has been confirmed recently on television (see around minute 1:20) by Brett Tolman (in 2005, a staffer of the Senate Judiciary Committee, and later, a United States Attorney), during the days of my fight with Wall Street I worked with the Senate Judiciary and the FBI to get to the bottom of Wall Street malfeasance. During that time, a female FBI agent taught me something invaluable: “the secret of female intuition”. Looking back, it really was an amazing process by which she got me tuned into a frequency for which I did not know I had the crystal (though we have not seen each other in a decade, I remain grateful). Essentially, it amounted to walking through my memory of meetings and conversations, quieting my rationale mind, and listening within my memory for things that felt out of place. Before long, I learned that my mind was often noticing things that felt wrong, but that I, a typical guy who walked, talked, and thought like a bloke, had been stumbling past, because my rational male mind demanded logic and proof. Eventually I learned that clues in life are all around us, if we let ourselves tune into them. That is how my radar got turned on in a way that I could help them sort out the rampant criminality on Wall Street in 2005-2009.

About six months ago that same radar started pinging like mad for me around Overstock.

It coincided with word of a lobbying campaign being conducted by OSTK longs: “If you get rid of Byrne, the stock pops to $50.” I did not feel it was my place to lobby against it, so I pointed out to the board once or twice only that:

- The putative longs making such a claim might not really know what they were talking about (you would not believe the number of times people have called up the firm saying, “If you do X the stock will do Y,” as if they have some crystal ball regarding such matters: in the past I had always been able to convince management and the board that this was a stupid way to run a company);

- The people making such assertions might not even be longs, they might be insincere shorts (yes, it has been known to happen);

- There was a non-negligible possibility that if I left the stock would go to $8;

- There was data (such as a negative rebate of 90%) suggesting the price of OSTK might be being driven by other factors.

But I felt it was beneath me to lobby for my position, especially as other things started happening around me that made my radar go off in funny ways, just as it had in the days of my mitzvah with Wall Street. It was not just the data at hand, it was the response of other parties to the data, that grew concerning (just as with Wall Street in 2005-2009, it was not just the evidence of the underlying crime, but the oddness of the reaction to that evidence by the proper institutions, that grew concerning). I am not going to point fingers, but I will say that for several months things started feeling hinky, not just to me, but to the people within Overstock whom I consider “super-talented,” the Gullivers of the firm. I was repeatedly warned by those I trust there that something bizarre was in the works. But my attempts to locate and confront it were met with blank stares and shrugs by the concerned parties.

Unfortunately, I could not stick around and get to the bottom of it because of word we received in mid-August that it would be impossible to get D&O insurance if I were in the firm. Within minutes of reading that news on a Saturday, I gave notice to the board of my intention to resign, acknowledging that it was “decisive.” On Monday I announced to the senior executives of the firm my decision to leave, and went to finalize a 10b5 plan that had been in the works for about a month, one that would have had me selling ≈ 200,000 shares into the volume we expected to pick up in mid-September, then leak the rest of my shares out over 3-4 years. I long ago gave up trying to predict what the price of OSTK would do, but one thing I was certain of was that the volume had to expand in the week before the dividend record date.

However, as I have disclosed previously, on Wednesday of that week, 24 hours before my planned departure, I learned that the truth about the D&O insurance was not as straightforward as I had been led to believe. I thought of reversing course, but that kind of gaslighting had happened in waves over years. I also received word that the firm wished to disassociate itself from me so completely that I was not welcome to speak at an upcoming tZERO party. Realizing the Gullivers had been correct, I decided to continue with my plans for departure, but not go through with the 10b5, and instead, since the board was so keen to be dissociated from me, to punch out completely, cutting ties with all subsidiaries and selling all my OSTK shares into that mid-September swell in volume.

There were two meetings of senior executives (one in my office with five or six people, one in a lunch setting with more) where I explained my intention. My desire was for them to understand that, while our forecasts at the time showed that we would be able to make things work without new capital (2020’s Retail cash flow looked like it would support our blockchain needs), as a fallback plan and to quiet their concerns, they should know that as a result of my sale, I would be standing in the wings with plenty of capital for the firm should turn out to need it.

In the two months since I left, the count has grown to at least nine people who can confirm that I made that decision and informed them of it in the 24 hours before I left. I am confident that at least seven will. People who were in the room, people who will confirm that others were in the room, people outside the room who will confirm the people who were in the room, and so on and so forth. And those nine people are without counting the bankers, lawyers, and accountants who immediately began making arrangements for it all.

With my accountant/lawyer and bankers I set the equivalent of a fire-and-forget missile to launch in the week before the dividend, then went off to Indonesia and began floating around on a dive boat, as out of the loop as I could manage to make myself without climbing into a bathysphere. My purpose was this: who the heck knew how things were going to work out? However they did, someone would be connect this dot to that dot and say that all along I played such-and-such a game. No matter what dots came into existence, there would be some such story that could be told, I knew. So I flew to West Papua and went diving. From that point on electronic communications were unreliable (though periodically I could write and post blogs), and attempts people made to contact me were politely rebuffed.

On Sunday, September 15, a text was sent me from one of my friends within Wall Street (one of the Staten Island fellows who seems extraordinarily well-plugged-in). For now I shall call him, “Huggy Bear”. We had been largely incommunicado for about 18 months, but his reach-out alarmed me. I will share below out text conversation, sanitizing it (for example, of personal matters) only slightly with brackets.

HUGGY BEAR: Hey man I hope you are doing well. Relaxing. I have spoke to [that economist-advisor I employ on the side] a couple times of late. I know ur not involved at all and know nothing and have no say. But just between us girls, [OSTK MANAGEMENT] is gonna get intense heat to postpone Record date. It’s a security and it’s 144 eligible. They [the SEC] have already allowed the OstkO to be traded on [the tZERO] ATS. Why would more of the same shares be any violation[?] If [OSTK management] blinks and agrees to announce it’s postponed, IMHO the stock will get crushed. And the tZERO ats viability will get be re-litigated. They have to [take the risk] and do it.

Just between friends. This is the moment.… The dividend is legal and it has a venue and the only thing they are supposed to do is protect investors. No one can lose a penny on this. And the Computershare transfer agent can ultimately hold the dividend FBO and can accept liquidating transactions.

PATRICK: Thanks man. I am in Indonesia and have not even had reception for four days. Papua.

Best scuba diving I have ever seen in my life. Now I’m going surfing for a week…

I will forward your thoughts to [OVERSTOCK MANAGEMENT]. They seem smart.

Thank you for giving [my economist-advisor] your advice about things.

HUGGY BEAR: Bro. Thank you for responding. But as friends I’m telling u I know u still have a significant stake in ostk and tZERO….. If we can’t do something we have already done with their [the SEC’s] approval then it calls the whole progress of tZERO into question. They [the SEC] will quagmire this thing til eternity. I know ur chiillin and u deserve it. But someone has to tell them to stand up straight to these motherfuckers [the SEC].

PATRICK: I will do so. What makes you think there is a bunch of pressure about the postponement? What do you know? Please fill me in on everything you know about that.

HUGGY BEAR: I am hearing chatter from big brokers that they’re not concerned about the div because there’s “no way” SEC is letting it happen. Instead of figuring out how to adapt they r relying on big brother to bail them out.

Some of my favorite reorg guys are telling me no one believes the SEC is going to allow this to fly.

I don’t KNOW anything other than my gut. And it tells me they r expecting a bail out.

And if ya ask me if the new leadership caves to ANY postponement OSTK is $10 and we never get another bite at this. If someone has a backbone and stands tall OSTK is $48 by Friday and every pub[lic] co[mpany] on the street will be at tzeros door asking to do the same thing for them…. If [Overstock management] thinks they can play nice with the regulators when we are well within our right… We cannot be prohibited from doing something they have already allowed us to do…

PATRICK: What is a reorg guy?

HUGGY BEAR: Back office. They handle reorganizations. Dividends Splits special distributions symbol change etc. they clean up all the slop.

PATRICK: c. derpcapture [“See deepcapture”: I had written “Philosophy, Poker, & Pigeons” and posted it that weekend]

HUGGY BEAR: Excellent piece. Hopefully [management] stiffens backbone and charges forward instead of relenting… this is a watershed moment. You have told me many times when my emotions overcame my reasoning… let’s not die on this hill. My friend this is the hill.

There is a window from November to May to educate the shareholders and their brokers. For anyone who doesn’t approach tZERO and set up a wallet the Transfer agent can hold the digital dividend in safe keeping until the rightful owners collect them….

Here’s the thing. The SEC is there to protect investors. No retail investor can lose a penny. [The] Only ones in harm’s way are shorts. Shorts are sophisticated investors. They have been notified in 8k that this was happening. They took the risk anyhow.”

So I telephoned Huggy Bear.

To set the scene more fully:

I think it was around 2 a.m., and I was on a traditional Indonesia sailing vessel called a “Phinisi” sailing in the waters off Raja Ampat, near West Papua, Indonesia. There is rather serious civil unrest in Papua these days, as a result of which the authorities are turning the Internet off intermittently to prevent dissidents from using social media. Connectivity was determined for me those days by what island we were sailing by, if there was or was not a cell phone tower on it, how the civil unrest was running on-shore, the humidity, which way the wind was blowing, etc. Because of this, as I have previously described, I had put my own sales on a fire-and-forget program: I was cashing in chips from 20 years of play, and I was not prepared to manage it through such noise in the communications channel. In fact, that is one of the reasons I had chosen such a location, so that in the aftermath there could be no doubts raised about my fire-and-forget missile.

But Huggy Bear’s texts presented me with a clear ethical dilemma.

I had the crew string an extension cord up to the roof, climbed up on the base of the mast, held their wireless router/cell antenna (plugged into the chord) up over and my head, and had a choppy conversation with Huggy Bear. He gave me the who, what, when, and where of what he was hearing. He described conversations with people from several brokerages who said their bosses had been informed by the SEC that the SEC was going to kill the tZERO dividend, and that they had been instructed to pass word to their clients. In fact, on the afternoon of Thursday, September 12, they had been saying it was going to happen, and then on the afternoon of Friday, September 13, they had said it had happened, Huggy Bear told me.

In that regard we discussed two points of extraordinary interest. The first was that, while OSTK was on the SEC’s Reg SHO threshold list, and by the terms of that regulation it should be impossible for the number of shares shorted-and-not-delivered go down, in the week leading up to September 13, the number of failures was going up. In other words, as flimsy and near-meaningless as Reg SHO is, in the week before the dividend, the SEC was turning a blind eye to enforcing even that when it came to OSTK (see “On Any Other Day That Might Seem Strange”, September 17, DeepCapture.com).

The second and more important point is this: remember that far above I mentioned that around the time of this dividend, my advisor-economist was tracking information regarding trading in OSTK, the volume, negative rebate, the average days outstanding of the short positions? And if the stock price reached 50% above the price it had been when one counted back a number of days equal to the average days duration, it would trigger margin calls, which would finally force the market to clear? No more counting on the SEC to enforce the rules: the laws of economics would finally be permitted to do their thing?

On Friday, September 13, the average short position had been on since July 26, 2019. And on July 26, OSTK was trading at $20 even.

Again, short positions on margin can move against their holder 50% before triggering a margin call.

This meant, both Huggy Bear and my advisor-economist pointed out, that if OSTK touched $30, there would be margin calls against the shorts. Positions would have to be abandoned. This would trigger that $1 billion – $2 billion loss for Wall Street that I estimated above. So it was imperative to the brokerage community that OSTK not be allowed to touch $30, lest they and their clients be facing a $1 billion to $2 billion bill (and perhaps more).

Here is the OSTK trading chart for the days before and after Friday, September 13, 2019.

Notice anything? On Friday 13 at 10:24 a.m., OSTK reached $29.69.

Then it collapsed. Almost as though the word had gone out that the SEC was pulling the plug on the OSTK dividend. Precisely as Huggy Bear was told the evening of September 12 was going to happen, and as he was told on the afternoon of Friday, September 13 had happened. And just as he described to me on Sunday afternoon (his time). As you can see from the chart, in fact, over 5 million shares were sold into the market that very moment. Someone had a lot of confidence about something.

A week later, Huggy Bear (a.k.a. John Tobacco) and I discussed that conversation on his show. Watch especially from minute 5:00 forward.

In that interview Huggy Bear was being discrete. He has clear and specific information about the brokerages to whom the SEC had leaked the information.

Though at that point I am not sure I had any fiduciary duties to the public (having left my position almost a month earlier), I did a number of things:

- I wrote a blog laying out the information that the SEC had leaked information to its clients (the bulge bracket banks) that it was taking action to kill the dividend;

- I contacted my agents and strenuously reinforced the imperative to let the fire-and-forget missile complete its trajectory but only after I got to the public the information I had learned (don’t ask me why I felt some obligation to the public to do that: old habits die hard, I suppose);

- That is when I broke near-total radio silence with my former colleagues long enough to pass all this information on, and came down strenuously on the side of not blinking. I knew I was selling anyway, but I let them know that I thought for the good of the firm this was the moment, and that if I were there I would be willing to face criminal referral from the SEC rather than let them Bazoomba! the dividend on behalf of their clients (the bulge bracket brokers and their clients who would have lost that $1 billion – $2 billion if the SEC had let events play out). One reason I would have been so adamantly opposed to blinking is because of the harm it would do to tZERO and OSTK holders. But the other reason was that I had dreamed of getting the SEC into a court and this was the right opportunity. It was the first time I had had a moment of regret about leaving the CEO position a month earlier: it had cost me the opportunity to face-off with the SEC in court with a set of facts of which I had dreamed since 2005, in a way we could go to court and put their captured crony-capitalist asses on trial.

Current Overstock management has a different style than mine, and different risk tolerances. I can appreciate that. They are nice Utah people, with families and such, and probably the threat of a jail sentence intimidated them. They blinked.

About a week after the events in question (around September 24?) I learned how it all went down. On the evening of Tuesday, September 17, the firm made the decision to delay. The next morning, on Wednesday September 18, they announced the delay along with their intention to take all proper and necessary steps that will allow them to go forward with the dividend in the near future (I believe they announced three to six weeks but check those facts in their releases for yourself).

I sincerely hope it works out for them. My fear is that whatever they do, they are going to be told, “Bazoomba!” Then, “Only one Bazoomba per night!” And then, “Only one Bazoomba per night unless your standing on one foot!” And the Bazoombas will go on and on, and they will never be allowed to dividend to their shareholders a security that has already been trading free, clear, and legally on the tZERO ATS, because that dividend would expose precisely what the Dole Foods litigation exposed, and the SEC has been fighting against me for 14 years to keep hidden: the system has lost track of who owns how many shares, and a non-forgeable blockchain-based security issued as a dividend would expose this, and their clients (who have a lot invested in keeping that secret) would get their asses handed to them to the tune of $1 billion to $2 billion.

I am out. I have no shares, and no economic interest in the matter anymore. Still, it was sad to know that Overstock was holding a royal straight flush against Wall Street, the hand for which we had waited for 15 years, and see them get Bazoomba’d by the SEC.

I do have a question about it, though. Between Huggy Bear’s quite specific information, and the trading chart above, it surely appears that the information that the SEC was killing the OSTK dividend was known to select brokers on Wall Street (some of whom are named in that video above). Between 10:24 AM on that Friday September 13, and the opening on the morning of Wednesday, September 18, those brokers and their clients had extraordinarily valuable information regarding the regulatory intentions of the SEC, from the SEC itself.

Is that odd?

Also, do these different data points line up in any way? Does the fact that the shorts in OSTK were facing a likely $1 billion – $2 billion loss, the odd behavior of a few parties around Overstock, and the decision by the SEC to call “Bazoomba!” on behalf of the shorts (and leak it to them in advance), all line up in any way?

Just as interestingly, does it count as MNPI (Material Non-Public Information) when the SEC is the one doing the leaking? When they are leaking to their favored bulge bracket brokerages information that not only saves those brokers a $1 billion to $2 billion trading loss, but permitted the possessors of that information to make an additional ≈ $300 million in the three days after that? Between 10:24 a.m. on Friday the 13, and the announcement of the delay of the dividend on the Wednesday the 18th, more than 30 million shares traded on the information the SEC passed them. Did the brokers who traded on that, knowing that it was material and non-public, break any laws? Or, when the SEC is leaking the information to its favored clients, does that obviate the normal rules on MNPI?

Thorny issue. Talmudic, even. But inquiring minds want to know.

So let’s ask the Inspectors General of the SEC and the DOJ their opinions.

SEC: [email protected] . Or contact DOJ

Overstock should offer a tZero TZROP dividend after the OSTKO dividend and also a Ravencoin dividend.That should do the the trick.

If the OSTKO digital dividend is not “allowed” by the SEC,would it be time for Overstock to voluntarily delist from Nasdaq and convert/move all shares to OSTKO shares currently listed on the ATS and later the upcoming BSTX exchange?

Will certainly be interesting to see how this plays out.

BTW,there currently still are some brokers who will not accept any opening orders on Overstock OSTK due to the unknown status of the digital dividend and only accept closing orders.

You can’t even buy 1 share of OSTK at certain brokers .

Patrick,thanks for this great article.Have a good weekend.

22010. Failure to Deliver and Failure to Receive

(a) Borrowing and deliveries shall be effected in accordance with Rule 203 of Regulation

SHO, under the Exchange Act. The Exchange incorporates by reference Rules 200 and

203 of Regulation SHO, to this Rule 22020, as if they were fully set forth herein

So how is this any different than what we have now. I though BC was supposed to fix this.

https://www.sec.gov/rules/sro/box/2019/34-87287-ex5a.pdf

I bought OSTK when the divined news came out. I did it specifically to have an account at t0 and something in my account. I am down over 50% ATM but holding to get that dividend. What I expect to happen if the dividend does go through is for Ameritrade to declare my trade a busted trade and take my OSTK away from me.

If this happens who would we can open a class action against?

I seem to remember from my reading of deepcapture back in ’08 that the fails totaled something like $6 billion a day. If the OSTK water boiling in the pot is only a few drops of all the companies boiling in that pot and to release OSTK would release all of the companies from the pot, $400 mill or even $2 billion is just the cost of doing business.

Patrick,

The SEC should be charged with RICO violations. Your evidence, when combined with my irrefutable evidence against the SEC would qualify. I have full proof the SEC purposely entered false evidence into a Federal case involving naked short selling..They then concealed this false evidence from the Judge. This caused irreversible harm to 50,000 shareholders. My evidence has been vetted and verified by Attorney Gary Aguirre. The evidence is so egregious and damning, the public will demand an investigation. I will provide all to you upon request. If you follow me on twitter, you can private message me. Or ask Mark Mitchell. He has my contact info.

what about FOIA

get in line we were all robbed You walked with $90M most of us have a pile of dogshit

Thanks for being nice and holding back all this great information AFTER all the investors were raped. If you had balls you would have spoke up when you heard the story at least people could have traded on same information and NOT averaged down like morons

Months later the big boys all have a new Maybach everyone else a tax loss and you look like a fool most have moved on .

That about sums it up

And Tabacco made how much from OSTK?

I’d still like to hear an explanation for why Patrick was unaware that the earnings from retail (which should be unrelated to this) would be restated just a month after leaving. Either he was in the dark about what was going on or he’s not being totally forthcoming.

Asked and answered in earlier blogs. Sent relevant docs to Charles Gasparino.

https://www.foxbusiness.com/business-leaders/fmr-overstock-ceo-patrick-byrne-exit-stock-sale-deep-state

But just to summarize: I was indeed completely in the dark on that (and it was not a change in earnings, but in projections). Also, on the zero hedge I see information about the housing market that suggests it’s still had some vitality in it through August, but in September started to decrapitate. I do not have the inside information, but I bet you catch up that 50% or more of the change in projection came about because the housing market turned a corner sharply in September.

But just to summarize: I was indeed completely in the dark on that (and it was not a change in earnings, but in projections). Also, on the zero hedge I see information about the housing market that suggests it’s still had some vitality in it through August, but in September started to decrapitate. I do not have the inside information, but I bet you that 50% or more of the change in projection came about because the housing market turned a corner sharply in September.

You don’t read too good, do you, Sparky? From above:

“I wrote a blog laying out the information that the SEC had leaked information to its clients (the bulge bracket banks) that it was taking action to kill the dividend;”

https://www.deepcapture.com/2019/09/whats-crazier-the-sec-or-the-true-story-of-the-death-of-james-foley/

I, in fact, did contact my agent who was handling the selling of my shares and told him he could not start until AFTER he saw me get a piece up.

You might retort, “An essay on DeepCapture is insufficient notification to the whole market.” To which I respond, “I had not been with the company, and had 0 obligation to inform the market of anything. And remember, the information we are talking about is, “The SEC has leaked to the market the following information.” If they had not done so, nothing would have gotten back to me and I would have floated around blissfully unaware of everything. The only reason the Cone of Silence was pierced is because Huggy Bear contacted ME.

It sounds like you have a reason to be sore, though: I gave you the SEC info you need above:

[email protected]

A pro friend has explained to me that the hedge funds which are also market makers get around the “borrow” costs and essentially pay nothing. The DTC system is completely corrupt with their IOU’s and as Caitlin Long stated in her Reason interview, they don’t need to possess shares, they just need to point to something and say we could get them from that if we needed to. I assume a good bit of this is done via swap contracts. Everything hunky dory with the settlement system! Allowing hedge funds to also make the market is key. I think the negative rebate ain’t what you think it is or even close to what it should be and just another carved out license to steal between the DTC and the primes! Could the system be more corrupt that even YOU thought?

They don’t need to possess just need to point… now you’re freaking me out

So what happens if the DTCC is forced to settle all the FTD that were grandfathered in before Reg SHO?

The correction could make the depression look like a walk in the park.

http://counterfeitingstock.com/CS2.0/CounterfeitingStock20Full.pdf

Also, if the SEC is indeed in bed wth the awesome money and power of the funds (they are), it’s not difficult to understand why they can’t allow this to get out. Why do you think Citadel has an army of lobbyists fighting reform (Blockchain)? Something tells me Trump has to know. If not, let’s get on with helping him and others understand how much wealth is “captured) and lies on the balance sheets of a tiny few at the expense of many!

You must have been considering re-joining Overstock, as CEO or any other position in which you get to continue your fight against the SEC. I’d understand if you didn’t want to do that, but wouldn’t that be THE chance to maybe get them, eventually?

I do not want to do that. I am enjoying life. I made a couple other investments with $17 million of the money. I am sleeping without worries for the first time in 20 years (since I last spent time in Asia). I think there is going to a lot of controversial news in which I figure, and it would be inappropriate to be running a public company under those circumstances.

Fair. I guess we were excited about the dividend and the repurcussions, want to see it happen, but were a little discouraged by the recent developments.

Plus, Indonesia is awesome and on the right track mostly. If you consider investing there, get in touch with Asia Land and Sea, they have a great vision and unique projects particularly in the Flores/Komodo area.

Question: i assume the SEC has contacted OSTK leadership and said. “We are not allowing the ostko dividend because of BAZOOMBA X. Is X the Rule 144 restriction on the div shares? .That’s the bs excuse they are came up with or is there more to it?

I read that JJ has requested an extension and that the 144 restriction will be taken off. 3-6 weeks and ostko div should be reliisted. That seems like a pretty routine process, unless the SEC is just flat out going to make stuff up to throw in the road.

I have no idea.

But I will not be shocked if the SEC just flat makes stuff up and throws it in the road.

However, now that I am gone, AND NOT A SHAREHOLDER, the chances that they relent go up. You will understand why if you stay tuned.

“Overstock was holding a royal straight flush against Wall Street”

That’s why I was so heavy into OSTK. I knew you’d never back down – and would win. Return of the King?

what about setting up a offshore exchange with NO short selling and use Blcokchain to setle it,

a Venture exchnage so all the small and mid caps can leave the USA and grow and then come back and get raped if they choose.

Call Tom Ronk you remember him a guy from 16 years ago fighting the fight

maybe you and huggy bear can invest he did very well I hear

WOW, there’s a lot to consider in this article. So, I’ll get right to it. No, I didn’t read the whole piece, but it wasn’t mentioned in the video, unless I missed it.

Of course, there’s something rotten in Denmark.

Although, we’ll not be seeing another investigation into the events that took place in the days leading up to 9/11, we should. Not that it would do any good. The SEC, has destroyed all the evidence. But nothing screamed collusion loader than the PUTS, filed against the various corporations that suffered the biggest losses on 9/11.

Just a little dot cnnecting.

4. Only way to get Overstock to blink on the digital dividend is without Patrick Byrne. Patrick Byrne pulls the trigger no matter what.

3. Only way to get rid of Patrick Byrne is for him to voluntarily leave because he thinks it is in the best interest of the company and the shareholders. But you would also have to make him believe that his staying would adversely affect both.

2. Short of framing him for a crime you would have to make him do something that he felt was more important than himself or the company. Something that might seem outlandish. Something that would invoke his sense of patriotism.

1. But you would have to have an influencer, someone he trusted. Someone that could give him a little nudge to do something that might hurt his company but was for the betterment of all. Someone who arguably benefited more from the current Wall Street system than any other human on the planet.

Funny things pop into your head after a good night’s sleep.

Keep your friends close and….

Yo Pat,

Why don’t you take some of that liquidity and fund a class action shareholder suit against the SEC and the other mother****ers?

Discovery could prove what’s what.

May save yourself from the stain of what some will say is ill gotten gain at the expense of many, many others. Our cumulative loss has been much more than your gain.

I’ll let you off the hook when the market returns to the valuation it was when you sold.

Otherwise, you have been properly framed to look like a scumbag who grabbed the booty and scuttled the ship with all on board.

You’d need to fund it because it’s probably a loser. Everyone will point at you, but they already do anyway.

Just offering a possible arrow for the quiver. You have the the string for the bows. You could not have done that from inside the company, either.

Just a thought since you said you would use your funds to help OSTK and tZippo,

I wanna believe.

Bear with Huggies,

Talk to the board, dude. They wanted me gone from the firm, saying they were worried about the “optics“ of any association with me. I gave them what they wanted. They are YOUR representatives: you talk to them.

Wow! What advice do you have for middle class workers stuck with an employer funded 401K? Opting out is not an option- though I can minimize my contribution.

Patrick,

I sent an email to Steve Bannon via his website https://citizensoftheamericanrepublic.org/

and suggested the two of you get together (excerpts):

“I’m playing matchmaker. I’d like to see a youtube video of you and Patrick Byrne sitting down together at a small table, sipping iced tea: ‘Bannon and Byrne: A Conversation.’ You’d have to go to Indonesia where he is hiding from the Deep State… Just start talking and edit it later. I think it would get a lot of attention…”

It would bring more traffic to DeepCapture since Bannon’s viewers are global, and it would be an opportunity to speak uncensored. Some topics could be bitcoin, blockchain, Trump, politics, media dishonesty.

Did you know how much in common you have with Steve? I watch videos of both of you and one day it clicked – these two have a lot to say to each other.

“You and Byrne are alike in many ways: Charismatic, driven, highly educated, successful entrepreneurs, finance backgrounds, Irish Catholic altar boys, fighters, vilified by presstitutes, despised by the Left, big banks and Wall Street so need personal security, proponents of bitcoin; you were in the Navy, Patrick was rejected by the Army; quick tempered Sagittarians who like to travel with a fondness for Asia; problems with women, and last but not least, you both have great hair!”

I don’t know either one of you but have learned a lot from watching your videos. I told Bannon to try you via Twitter or DeepCapture. Nothing says you can’t contact him first. His/your staff can figure it out.

Something to give all of us some hope for the future by someone who has every reason to have none.

https://twitter.com/i/status/1187067300504985600

After visiting my Tesla Service Center in SoCal today, I made the comment while their employees and shareholders are celebrating, that the people who are attempting to kill Tesla are Anti-Capitalism and Anti-American in what they continue to try to do in destroying the amazing Global Enterprise and clean energy company Elon Musk continues to succeed at building in spite of the attacks which continue to take place against him and his brand.

What I didn’t tell them and what is even worse is what happened and continues to happen to Overstock including its Medici Tech Hub. In this case, it’s the regulatory authority and body who is charged with protecting investors from market vagaries including illegal manipulation of supply/demand curves, who are Anti-American and Anti-Capitalism while they continue to aide and abet the interests of those same dark pool forces who conspire to destroy companies like Tesla.

This country is being destroyed from within by Captured Regulatory Bodies and Wall Street Prime Brokers along with their cohorts on the outer edge in attempting to make a Serf Nation out of its citizens through their direct illegal, interference with “free market” metrics designed to prevent that as part of inalienable “property rights” which no longer exist.

Patrick you censored my freedom of expression….and I do not take kindly to that. That remains most hypocritical.

SEC has given a “no action” nod of approval to this company as of yesterday. Any signs of a Tzero moat has been eradicated with this announcement, apparently. We are still scratching our heads in disbelief over this news item.

https://www.bloomberg.com/news/articles/2019-10-28/paxos-gets-sec-nod-to-use-blockchain-to-settle-stock-trades

https://www.paxos.com/securities/

spiramus.com/naked-short-and-greedy

Hot off the press Susan Trimbath’s book ‘naked short and greedy’ is now available on PDF , including the story of the only company which done a complete cert pull from the DTCC ” CMKX”

That has for ages been so, for Baccarat was played since Middle Ages.

Earn while you learn and add on the bankroll with online

gambling that’s planned and strategized. A person can make

from the variety of game sites to take pleasure from the rush

and excitement of gambling.

Everything is very open with a clear description of the issues.

It was truly informative. Your site is very helpful.

Thanks for sharing!

An intriguing disxcussion is worth comment. I think that you should publish more on this subject matter,

it may not bee a taboo matter but typically people do not speak aabout such issues.

To the next! Kind regards!!

Hello Dear, are you actually visiting this site regularly, if so after that you will

definitely get pleasant know-how.

web page

There is certainly a great deal to know about this topic.

I love aall the points yyou made.